Why You Should Consider a Standalone Retirement Trust to Protect Inherited Retirement Accounts

If you are like most people, a significant part of your net worth is contained in qualified retirement accounts such as IRAs and 401(k) s. The primary purpose of these accounts is to allow the account owner to save for retirement on a tax advantaged basis. In order to discourage early withdrawals and protect retirement savings from creditors, federal law provides for age based withdrawal restrictions and exempts a portion of retirement funds from the claims of creditors in bankruptcy.

However, when the account owner dies and the account passes to a spouse or a child, many of those creditor protections and withdrawal restrictions disappear, which can lead to some unanticipated and unwanted consequences, such as:

However, when the account owner dies and the account passes to a spouse or a child, many of those creditor protections and withdrawal restrictions disappear, which can lead to some unanticipated and unwanted consequences, such as:

- Beneficiaries can elect a lump sum distribution of the inherited retirement account and quickly blow all of the money through frivolous spending or poor investment decisions.

- Inherited retirement accounts are subject to the claims of creditors in bankruptcy.

- Inherited retirement accounts are subject to equitable distribution in a divorce.

- Inherited retirement accounts are subject to plaintiffs’ claims in a lawsuit.

- If a beneficiary with special needs is receiving government benefits, receipt of the inherited retirement account can lead to a loss of those benefits.

- If you are in a second marriage and have children from a prior marriage, your surviving spouse could (intentionally or unintentionally) disinherit your children from a prior marriage by electing a spousal rollover of the retirement account and designating beneficiaries other than your children.

Fortunately, there is a solution to these and other problems. A special trust called a “Standalone Retirement Trust” (SRT) can protect inherited retirement accounts from your beneficiaries’ creditors and your beneficiaries themselves. As the name implies, an SRT is a separate trust created in addition to any other trust or estate planning vehicle you may have for the sole purpose of receiving and administering qualified retirement accounts.

A properly drafted SRT:

- Protects the inherited retirement accounts from creditors, as well as predators and lawsuits;

- Ensures inherited retirement accounts remain in your family and out of the hands of a daughter-in-law or son-in-law or former daughter-in-law or son-in-law;

- Allows for experienced investment management and oversight of the assets by a professional trustee;

- Prevents the beneficiary from gambling away the inherited retirement account or blowing it all on exotic vacations, expensive jewelry, designer shoes, and fast cars;

- Enables proper planning for a special needs beneficiary;

- Permits you to name minor beneficiaries, such as grandchildren, without the need for a court-supervised guardianship; and

- Facilitates generation-skipping transfer tax planning to ensure estate taxes are minimized or even eliminated at each generation of your family.

- In second marriage situations, permits you to name your spouse as the lifetime beneficiary of the trust and then have the remainder pass to your children at your spouse’s death.

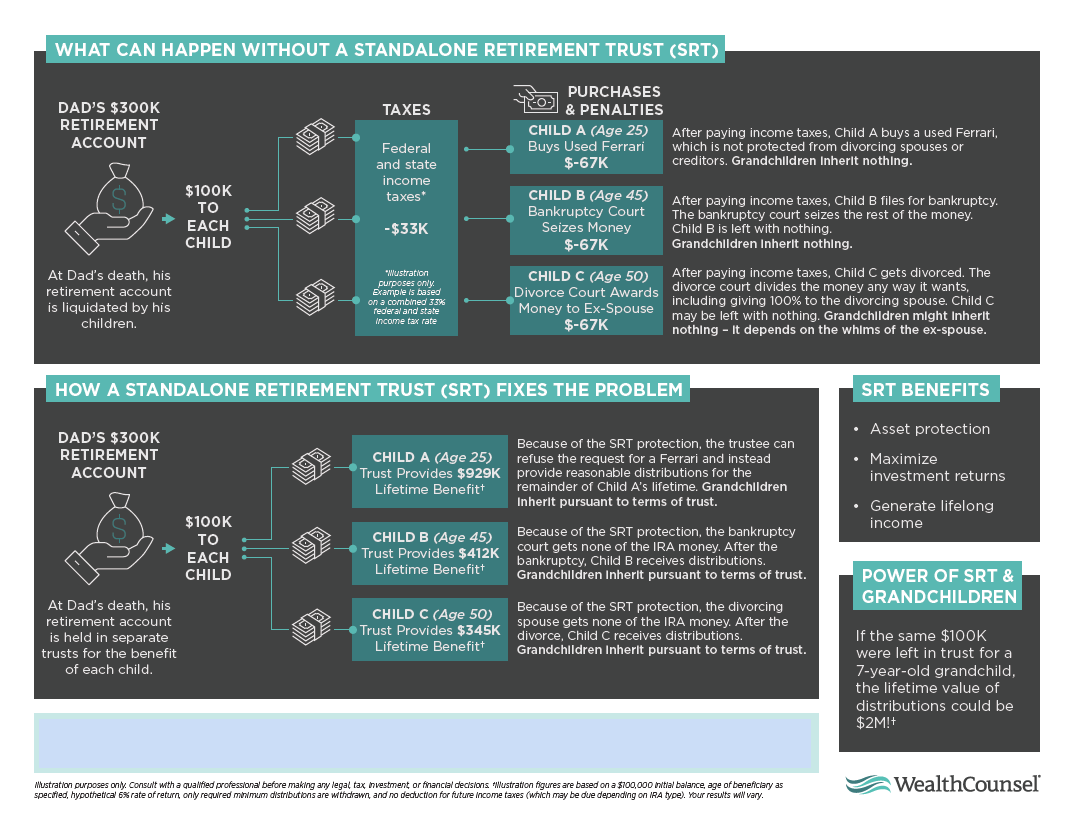

The following illustration shows some of the benefits of an SRT:

Diagram – What Can Happen Without a Standalone Retirement Trust

You work hard all of your life to save the money in your retirement accounts to provide for your retirement and leave a legacy for your spouse and children. Don’t let your beneficiaries or their creditors destroy that legacy. Give me a call and let me show you how an SRT can help you protect your assets as well as provide tax deferred growth for the lifetimes of your beneficiaries.